While caravan insurance itself is not technically a legal requirement, in reality, it is a ‘necessary evil’. A caravan is for many people a significant investment and you don’t want to be left completely out of pocket in the event of a road accident, theft, fire, flood or storm damage. However, you also don’t obviously want to pay more for your caravan insurance than you have to. As you would expect, various factors affect your caravan insurance premium cost. Such as where the caravan is stored and the number/type of security devices fitted.

The cost of your premium will also be dictated by your choice of a new for old replacement or market value payout.

So with this post, I’ll discuss the various factors which can help to reduce your caravan insurance premium so you can get the best deal. Furthermore, how to find the best caravan insurance providers.

Now, below, I’m going to reference some promotional videos from Caravan Guard, one of the main caravan insurance providers.

However, you should, by all means, use the information below to negotiate the best caravan insurance quote you can with other insurance providers, which I will reference at the end of the post.

Bear in mind the percentage of discounts for certain caravan security devices will change with different policy providers.

Furthermore, different brands of caravan security devices will often receive a different percentage of discount from different insurance companies.

Disclaimer: Hey! By the way… any links on this page that lead to products on Amazon or Caravan Guard are affiliate links, and I earn a commission if you make a purchase, with no additional cost to you 🙂

- Dissolves waste and removes odours naturally and has delightful mild fragrance

Want To Visit Horton Common? – Book Here

Table of Contents

Introduction To Caravan Insurance

While it is a legal requirement that your tow car is insured (and insured to tow a caravan), the caravan itself will not be covered under your car insurance.

Hence without caravan insurance, should you have an accident while towing, you would receive no return on any damage to the caravan.

But caravan insurance is not just about protecting your investment from damage while towing, its also about cover in the event of a theft or fire/storm damage.

There is a lot for me to discuss in this post on how to get the best caravan insurance quote possible.

To make the information easier to absorb, below is a video from the insurance provider Caravan Guard on some common questions they receive.

The first important point raised in the video above, is you need to insure your caravan for the whole year, not just while you are using the caravan over the summer months.

Insurance claims related to caravan theft are a significant part of any insurance company’s business.

Its far more likely that your caravan will be stolen while sitting idle on your driveway at home or at a storage yard than when the caravan is on a campsite.

Another good tip referenced in the video above is to keep your policy number and claims helpline number in your phone ready should you need to make a call to the caravan insurance provider.

Below I’m now going to discuss the specific aspects of choosing the best policy and how to secure some caravan insurance discounts.

New For Old VS Market Value Caravan Insurance Policies

A decision you will have to make when taking out caravan insurance is, do you want a policy which will provide a new replacement caravan or a market-value payout?

The point in time, when this choice comes into action, is in the event of a ‘total loss claim’.

In other words, the caravan has been stolen and unrecovered or fire/storm damage has occurred to the point its uneconomic to repair the caravan.

- New for Old: The caravan would be replaced with the same make and model or its nearest equivalent.

- Market Value: You would be paid the equivalent resale/retail value of the caravan. The insurance company will likely base this figure off that stated in Glass’s Caravan Guide.

With a new for old replacement, you will have to pay a higher premium. However, it also takes the hassle out of having to negotiate a deal for a new caravan with a dealer.

With a market value return, it’s probably what you’d expect to happen if your car was written off and you claimed under your car insurance.

Another thing to note with new for old replacement insurance policies is its likely year on year, your premium will increase.

Due to inflation and other factors, the new version or equivalent version of your caravan will cost more.

Therefore, it is key to check the insured value stated on your insurance documents remains enough to buy a new equivalent caravan.

If you think your caravan is your perfect choice, with the ideal layout, and you don’t want the hassle of going back through the caravan purchasing process, then a new-for-old policy may be for you.

Otherwise, the lower premium of a market value settlement may be your best option. For instance, you may want to consider upgrading to an 8-foot caravan.

Make Sure Your Caravan Upgrades/Accessories Are Covered

Something which you must remember to do is make the insurance provider aware of your caravan upgrades and high-value accessories.

For instance, if your caravan has a motor mover fitted, make sure they are aware of it and its included in the policy.

Furthermore, don’t forget to include the value of your awning in your insurance cover too. Motor movers and awnings are high-value items.

Therefore, if the caravan is stolen or destroyed, for instance, due to fire/storm damage, you want a return on those high-value items.

If you have upgraded your caravan with a refillable gas bottle system, you may want to have that included in the policy too.

If your caravan has a motormover fitted its an asset of significant value. Therefore you want to make sure its covered under your caravan insurance policy in the event of theft or damage to the caravan: Image – Amazon.co.uk

Caravan Insurance Discounts – How To Get The Best Deal

A significant part of securing the best caravan insurance quote is being able to benefit from the various discounts on offer.

Various factors influence whether the caravan insurance provider will or will not provide you with a discount for your choice of storage location and security features.

If you have purchased a second-hand caravan and you are not sure about the details/features installed, its not a bad idea to take it to a service centre.

They will check over the caravan and make sure its safe to use, and they should be able to provide you with details on the specific alarm system fitted and other security devices included etc.

The above video from Caravan Guard discusses the percentage discounts they have offered in the past and still do generally. However, those percentages may have changed.

Furthermore, those percentage discounts are only specific to Caravan Guard. However, all caravan insurance providers are likely to offer at least some discounts relating to the following security devices.

Though as I discuss in my post on caravan safety and security advice, not all security devices are acknowledged as equal by the insurance companies.

- Certain caravan hitch locks and wheel locks

- Certain caravan alarms and trackers

- Caravan CRIS registration and VIN Chip Plus

- Caravan tyre pressure monitoring

- Tyron Bands

- ATC electronic caravan stabiliser system

- Caravan reversing cameras

Most caravan insurance companies will provide their biggest discounts for fitting an AL-KO wheel lock and this black AL-KO premium hitch lock: Image – Amazon.co.uk

Caravan Storage Location & Insurance Discounts

Every caravan insurance company will want to know where you keep your caravan when its not in use. While some people use a caravan storage yard, others keep their caravan on the driveway at home.

Now, the amount of discount (if any) the insurance provider will offer in either of these circumstances will depend on a lot of different factors.

To learn more, please click on either of the links above as they will go to my specific posts on each subject.

Caravan Trackers – The Great Debate

Now, if you are a caravan beginner, you may not be aware of the heated debate within the caravanning community with regards to caravan trackers. A caravan tracker works alongside the alarm system.

If the caravan is moved while the alarm is activated, the owner can be made aware via mobile phone, text and email.

Furthermore, many trackers are monitored by a third-party service company that can also directly contact the police.

Insurance companies will provide a discount if an approved tracker is fitted to the caravan as the vehicle can be potentially recovered. Hence the insurance company wouldn’t have a ‘total loss claim’.

However, the annual cost the caravanner will have to pay to the tracking company is typically between £100 – £150, sometimes more.

In some cases, the discount the insurance company provides will not be more than the annual cost of the tracking service.

Furthermore, speaking to our guests here at Horton Common, I know some caravanners who would not actually want the caravan back if it was stolen.

Hence, they don’t see the appeal/benefit of keeping up the payments on the tracker service.

There are DIY self install/no contract/pay as you go tracking devices for a caravan. However, its unlikely an insurance provider will provide a discount for such a device: Image – Amazon.co.uk

Its a ‘tricky one’, and if your caravan is fitted with a tracker, you will have to decide if you are going to keep paying that annual tracker service cost.

However, to provide some ‘food for thought’, I’ve included a video below from Keith and Michelle from the YouTube channel Carefree Caravanning.

Unfortunately, they have gone through the experience of having their caravan stolen.

In the video below, they discuss their thoughts on the insurance claim process, new for old vs market value caravan insurance policies and, importantly, their thoughts on the caravan tracker debate.

Best Caravan Insurance Providers

Getting the best caravan insurance quote possible should not be a decision you base purely on price.

You want a policy which will provide you with the best value, and provide your caravan with the most comprehensive cover for the price you’re paying.

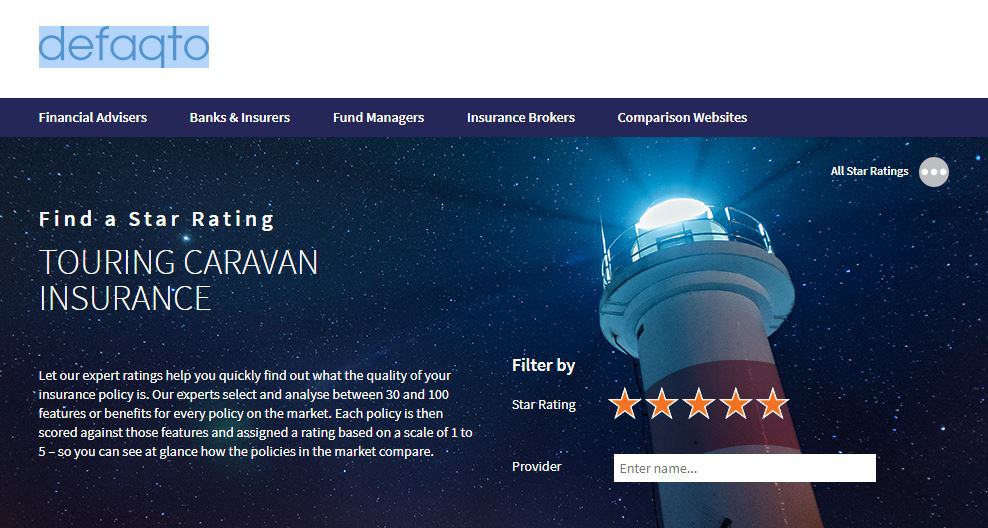

One tool to help you decide who you want to trust with your caravan insurance policy is the Defacto website, as referenced above in the first video. Defacto is an independent financial information business.

Annually they rate financial-based companies on a 5-star rating system reviewing between 30 and 100 features included with the insurance policy cover.

You will notice that Caravan Guard is one of several 5-star rated insurance companies offering policies for UK customers, making them one of the best choices.

However, you could also consider ringing around with your caravan details and policy requirements to other 5-star rated companies.

What about the 4-star to 1-star rated insurance companies? There are currently 14 companies rated at 5-stars for caravan insurance and many more offering policies at 4-stars and below.

It’s most important to find a policy that meets your needs. If you do go for a lower star-rated policy, check out what’s missing against the higher-rated ones and make sure it’s not an element of cover you need.

Conclusions On Getting The Best Caravan Insurance Quote

To make it as quick as possible when sourcing your caravan insurance quotes, you want to make sure you have all the important information to hand.

Obviously, the make and model of the caravan, but also its VIN or CRIS number, will likely be required, perhaps not at the quote stage but almost certainly when you go on cover.

If your caravan is kept at a storage yard, you need their full address and contact details.

If the caravan is kept on your drive, the insurance company will want to know if its kept behind locked gates, are security bollards fitted etc.

When it comes to caravan security devices, check with the insurance company for discounts. Many providers will ask for a wheel clamp and possibly hitch lock as a minimum security level.

As stated above, approved Tracking devices and the AL-KO axle wheel lock will likely secure the most significant insurance discounts.

However, these devices can be the most expensive type, and the AL-KO wheel lock can be a lot of ‘fun’ to fit if on uneven ground.

Furthermore, with regard to fire risk, I would encourage you to read my post on the best fire safety equipment.

I hope you found the information above on caravan insurance useful and that you can use it to get the best deal possible.

I also hope in the near future, you consider coming to visit us here at Horton Common caravan site to see our stunning views over the Staffordshire Moorlands and Peak District National Park. 🙂

Want To Visit Horton Common? – Book Here